|

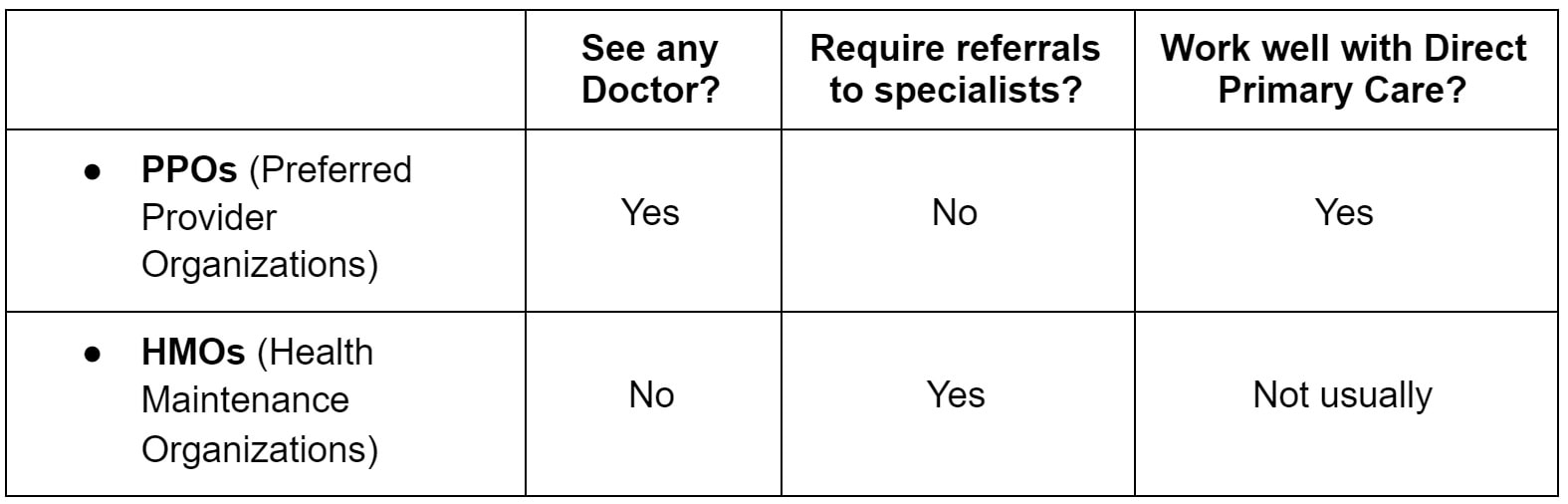

The two most common types of health insurances that we see today (outside of medicare and medicaid) are called PPOs and HMOs. The short and sweet of it is that HMOs are very restrictive and want you to remain in their “network” - which means you need a Primary Care Physician who participates in the network with them. Such a physician has signed paperwork saying they will follow the insurance companies rules, only refer you where the insurance company says, and receive payment when they bill your insurance of a set rate.

On the other hand, PPOs are flexible. They allow you to go “out-of-network” - including not only any specialist you’d like to see but also any primary care doc! That’s why we encourage patients to check their insurance plan before joining our practice. If your plan is an PPO, it lets us (as out-of-network doctors) care for you as you and we see fit. The gist is that we can see you, you can see who you want, and we are only paid by your monthly membership fee to be part of the practice. If you’re a patient who has lots of specialists and needs help with coordination, likes the idea of a doctor who is not “on the hook” with the insurance companies, or just plain likes the idea that you can choose who you’d like to see - a PPO plan alongside a DPC doctor - like the docs at Direct Doctors! - might be the perfect match for you. And no we don’t think this is paying twice for your healthcare - we think it’s making a smart choice for your health! For more on how we practice primary care differently, check us out at www.directdoctors.org. Comments are closed.

|

AuthorLauren Hedde, DO; James Hedde, DO and Mark Turshen, MD are Family Physicians and Co- Founders of Direct Doctors, Inc. a Direct Primary Care Practice. Archives

December 2023

Categories |

RSS Feed

RSS Feed